Micro Finance is an important concept which plays a vital role in developing the socio-economic status of the people categorized under the low-income group. It acts as pivot of the country’s economy. It protects the people from the inflating rate of interest.

In the post nationalization period Indian banking sector witnessed flow of substantial amount of resources and the banking network underwent an expansion phase. Credit came to be recognized as a remedy for many of the effects of the poverty. Credit packages and programs were designed based on the experience gained.

Microfinance is a general term to describe financial services to low-income individuals or to those who do not have access to typical banking services.

In other words, microfinance is also the idea that low-income individuals are capable of lifting themselves out of poverty if given access to financial services.

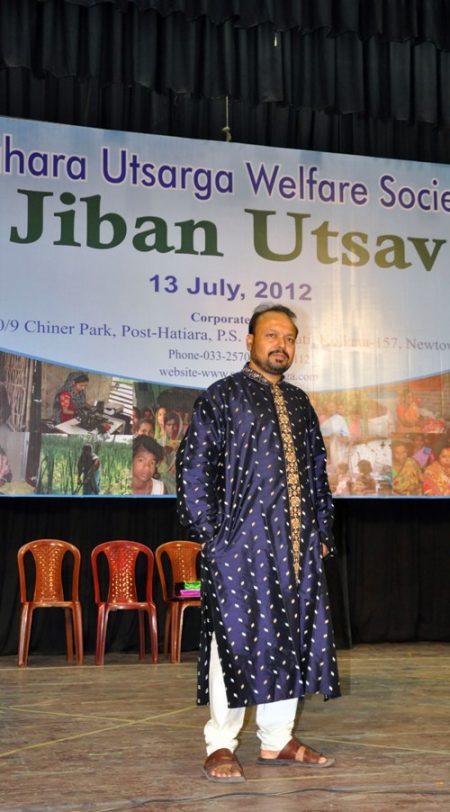

Sahara Utsarga came into existence in the year 1993 with their plan to start activities for removal of some basic problems frequently appear in human life. They started activities through free private tuition, pre-primary education, blood donation camp, campaigning for using Arsenic free water, health camp etc. Thereafter, to proceed further, SUWS, as an NGO was registered under Society Registration Act 1996 to have proper recognition and gradually started microfinance activities as a part of their new ventures, because it was realized unless there is financial freedom it is difficult to face all the problems on their own. Hence it was utmost essential for all to have proper livelihood through some income generating activities. So it was a movement to provide ideological support to poor and backward class people of the society, as many as possible towards permanent access to an appropriate range of high quality financial services to enable them to come out of poverty and lead a meaningful life.

More

Sahara Utsarga came into existence in the year 1993 with their plan to start activities for removal of some basic problems frequently appear in human life. They started activities through free private tuition, pre-primary education, blood donation camp, campaigning for using Arsenic free water, health camp etc.

In 2010 microfinance sector faced severe set back and badly affected due to A.P crisis and many of the banks/FIS were not supportive. Microfinance activity started suffering and members were affected badly. To overcome this SUWS started programs like Literacy Program, Entrepreneurship Training, Capacity Building & Leadership Program.

Journey of SUWS

Sahara Utsarga Welfare Society (SUWS) came into existence and primarily started the journey in the year 1993. Initially they took the move for removal of some basic problems in human life like free private tuition, campaigning for use of Arsenic free water, Pulse Polio & Hepatitis Vaccination, Awareness on Family Planning, Gender Education, HIV Awareness, Blood Donation Camp etc. SUWS commenced its journey in microfinance at low scale from 1998.

First Grant received from Indo German Social Service Society helped in opening the Pre-primary school effectively to prevent the practice of spoiling the poor children used as labour. Thereafter SUWS received several grants from different bodies and started Type and Short hand training, Computer training, Automobile training, training for women belong to SC/ST category, Literacy program on income generating activities, Women empowerment program and others, in stages. Role played by Utsarga for imparting awareness of human right as well as awareness of communal right & Voting Right was also important for that time. Creche Program was undertaken during that period.

Microfinance operation was started mainly from the year 2003-04, when they started receiving funds from different banks and financial institutions. With receipt of funds SUWS started opening of branches in potential areas. From the year 2008 onwards different banks and financial institutions joined their hands with SUWS and extended financial support to intensify the activities in the sector for benefit of the destitute. Upon receipt of funds from Banks & FIs there was a boom and SUWS opened around 150 branches all over West Bengal and more employees were hired to serve the increasing no. of members.

At the latter part of 2010 microfinance sector faced severe set back and badly affected due to A.P crisis and many of the banks/FIS were not supportive. Microfinance activity started suffering and members were affected badly. However, since good no. of people, either the members or the employees, were engaged, SUWS attempted to find alternative avenue when the industry started passing through a bad phase. To overcome the situation, the programs like Literacy Program, Entrepreneurship Training, Capacity Building & Leadership Program were undertaken.

Since the rickshaw pullers are working without any social recognition and their social security as well as standard of living were lacking, as an additional measure for the society Utsarga Rickshaw Sangh Project was undertaken in 2016 in association with American India Foundation (AIF) for changing the life style of Rickshaw Pullers.

More